Saskatchewan’s economy is built on trade, with one in three jobs in the province directly tied to exports.

The United States is Saskatchewan’s largest trading partner, with about $40 billion worth of imports and exports crossing the border every year. As such, trade with our American neighbours is crucial to our provincial economy. However, the products we export are also vital to the United States.

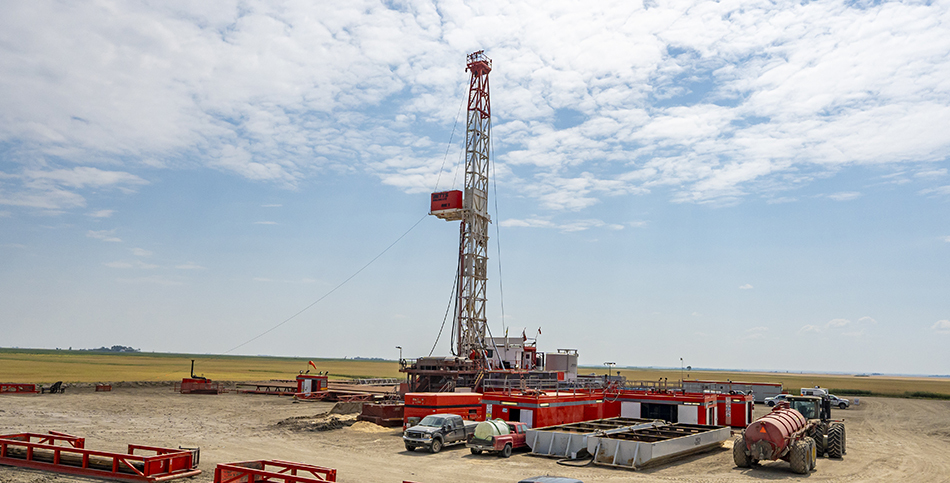

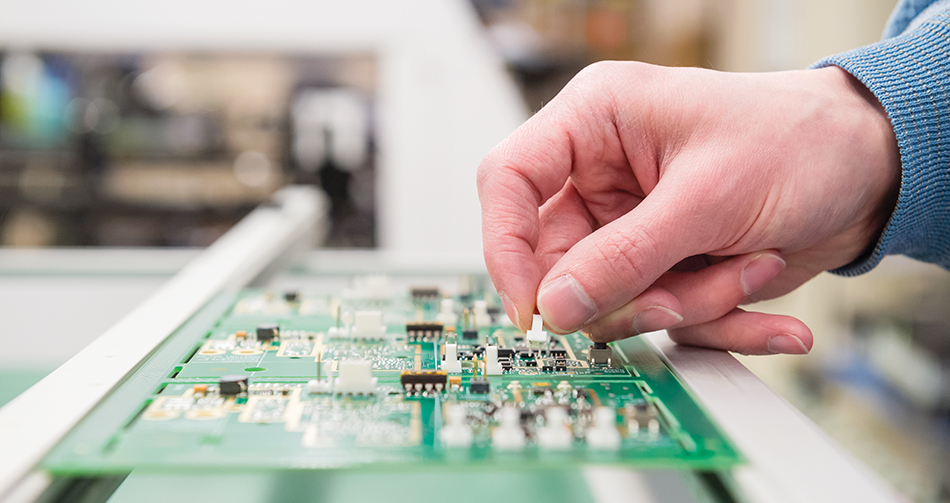

Saskatchewan plays a critical role in North American food and energy security, as we are one of the only places in the world that sustainably produces crude oil, natural gas, uranium, potash and other essential critical minerals.

This is why it’s so important for our country to quickly resolve this issue with the United States. Tariffs will increase inflation, along with the costs of fuel and groceries, for Americans and Canadians. They will also lead to job losses and drive down investment across North America.

Saskatchewan is currently working alongside their federal, provincial and U.S. counterparts to find common ground and emphasize the shared benefits of trade. We support strong measures to secure the Canada-U.S. border and have taken action through the new Saskatchewan Border Security Plan to ensure there are more officers and law enforcement present.

Provincial budget and tariffs

The tariff situation is currently fluid and changing daily. Regardless, we developed the 2025-26 Budget with the best information we had at the time, even though the situation around tariffs may change by the time our budget is tabled on March 19.

We made the decision not to build in an arbitrary contingency fund that will not have a direct connection to the situation by the time the budget is delivered. We do not know whether the tariffs are going to last for three days, three months or three years, nor do we know at what rate these tariffs will be levied over time.

Instead, we believe Saskatchewan’s strong financial outlook and responsible spending in the 2025-26 Budget will help position our province to weather the impacts of any trade actions.

Tariff analysis

On March 4, 2025, the U.S. administration imposed a 10 per cent tariff on Canadian energy and 25 per cent on all other Canadian exports to the U.S. The Canadian government has retaliated with a 25 per cent tariff on up to $155 billion of U.S. exports to Canada.

The following analysis is a worst-case scenario that assesses one full year of impact related to the imposition of the above-mentioned U.S. tariffs and Canadian counter tariffs. With the uncertainty around the length of any potential trade action, or the ability of the U.S. administration to add or exempt certain products from tariffs, this remains a highly dynamic situation.

The impacts to Saskatchewan’s overall trade were assessed by applying assumptions based on industry consultations for key sectors with respect to who will likely pay the tariffs, how much demand reduction can occur in response to higher prices, to what degree Saskatchewan exports can be redirected, and the extent to which imports from the U.S. can be substituted by new suppliers.

U.S. tariffs directly increase costs for U.S. importers leading to a reduction in demand from the U.S. market that is partially mitigated by Saskatchewan exporters diverting orphaned exports to new markets. On average, the analysis assumes about 20 per cent of orphaned Saskatchewan exports to the U.S. can be redirected to new markets. Similarly, Canadian retaliatory tariffs increase costs for Canadian importers, leading to a reduction in demand for U.S. goods that is partially offset by sourcing goods from new suppliers in other provinces or countries. The analysis assumes 50 per cent of displaced imports from the U.S. can be sourced from new suppliers.

To the extent that Saskatchewan can exceed these levels of export diversification and import substitution, the harm caused by U.S. tariffs would be reduced.

Of note, the analysis does not fully account for the impacts of currency depreciation, interest rate changes, investor uncertainty, existing commercial contract requirements or changes in relative competitiveness with other countries also subject to new U.S. tariff actions. Also, the analysis does not include any impacts from federal policy responses to support Canadian workers and businesses.

The uncertainties in this analysis show why including any amount of contingency in the budget at this time would not be realistic. However, the strong financial position of this budget leaves room to weather the potential impacts of any imposed tariffs.

This U.S. tariffs and Canadian response scenario could:

- Reduce the value of Saskatchewan exports to the U.S. by $8.2 billion, or 30.4 per cent.

- Reduce real GDP by up to $4.9 billion, or 5.8 per cent.

- Reduce revenue to the province by up to $1.4 billion.

The trade actions will also negatively impact American businesses and consumers. The U.S. will see the cost of imports from Saskatchewan increase by $3.5 billion and experience a $1.8 billion decline in exports to Saskatchewan (a net decline of $600 million in total U.S. exports). This will drive U.S. prices higher and create risk for U.S. food and energy security.

1,246,691

1,246,691 2nd

2nd 15,200

15,200 $42 billion+

$42 billion+ #2

#2 9

9